ARTICLES FROM THE 2022-23 VOTER NEWSLETTER

LWVPDX Endowment Fund, Part 1: Establishment and History

By Phil Thor, Endowment Chair, and the Endowment Committee

This is the first installment of a four-part series on the LWVPDX Endowment.

Establishment

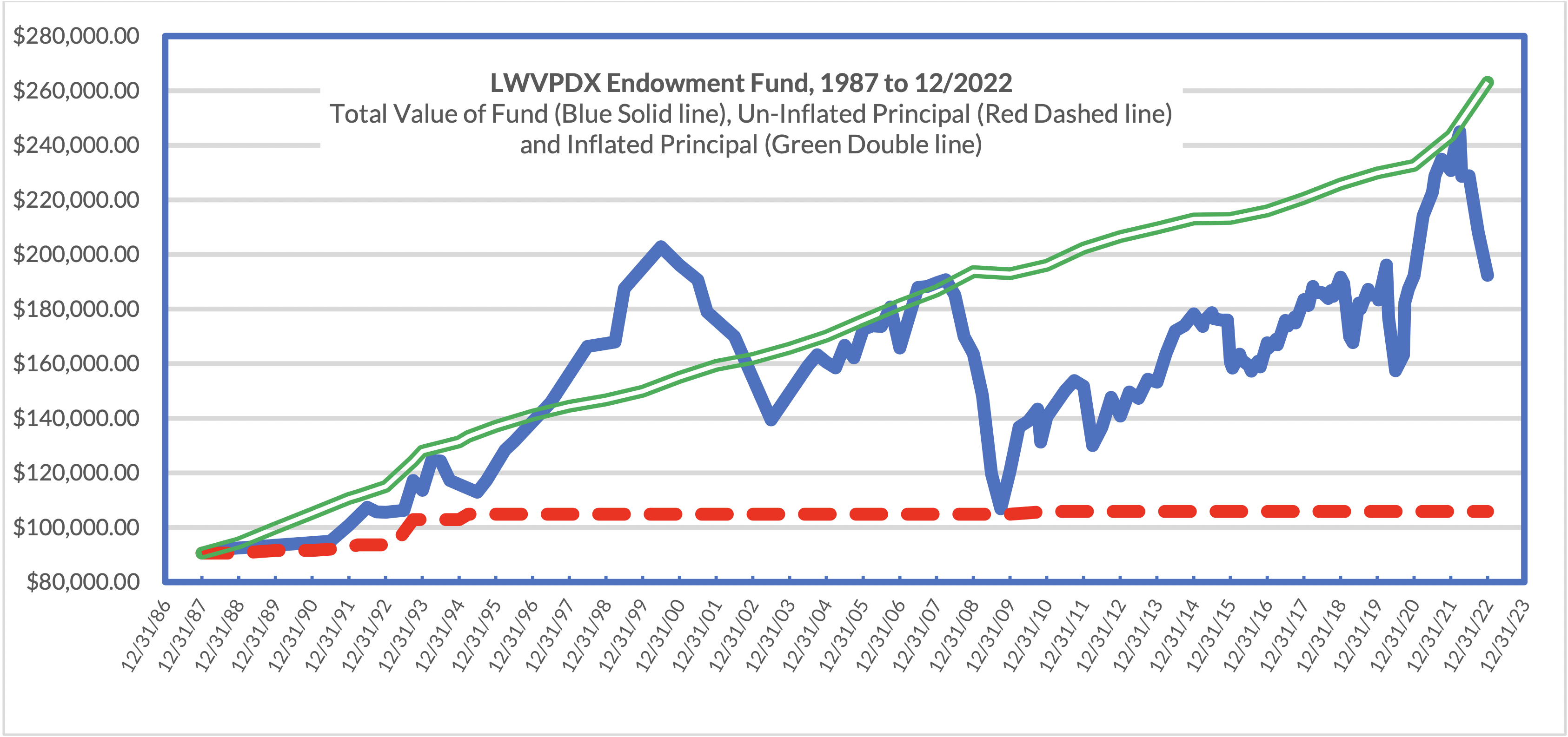

A bequest of $90,605.62 from the Mary Damskov estate was given to LWVPDX in 1986, which prompted the establishment of a Trust Fund (later to be renamed the Endowment Fund). This bequest represented 20 percent of her residuary estate, as conveyed through her Last Will and Testament.

The fund was increased over the next few years with additional bequests and one donation. Bequests from Jane Rasmussen, Elizabeth Ducey, and Pearl Gervutz of $1,000 each were received in 1989, 1991, and 1992. Three more gifts (two bequests and one donation) were added by Johanna Vanderwall ($9,253.47 in 1993), Marian Copeland ($2,000 in 1995), and Darleane Lemley ($1,000 in 2010). The total sum of the contributions, or “principal,” stands at $105,859. In endowment management circles, this total principal is known as the “corpus.”

Development of Endowment Guidelines

In early 1987, following the Damskov bequest, LWVPDX drafted guidelines to govern the management and distribution of this Trust Fund. A committee was established and charged with overseeing the fund, implementing the policies of the board and membership, and quarterly reporting on the fund’s status to the board (or the Executive Committee, if an emergency occurs). The committee comprised a chair elected at the annual membership meeting, two board-appointed members, and the LWVPDX treasurer serving ex officio. The adopted guidelines stated “the income should be invested and, barring exceptional circumstances, only the income earned on that investment should be expended.” *

Endowment Fund History

The corpus (or principal) has been invested since 1987 in a wide variety of instruments, such as bank certificates of deposit (CDs) and mutual funds holding a diversity of stocks and/or bonds. They are both short- and long-term, allowing for ready access to any earnings and for capital appreciation. Investment decisions are generally proposed by the committee and agreed to by the board.

In February 1990, the committee proposed a more formal Investment Management Plan that proposed investments into two categories: a cash fund and a protected capital appreciation. The first category was to provide money for operating expenses and was largely invested in 12-month CDs (which were often rolled over at maturity) and money market accounts, which would extend over the next three years. It was hoped that interest from these investments would cover the withdrawals needed to support LWVPDX operating expenses. The second category of investment had stated aims of “capital appreciation, with minimum risk” and “principal preservation and sustained growth that exceeds cash withdrawals from money market account.” *

Interestingly, the proposed 1990 Investment Management Plan also says:

We have assumed that the desire to support the League’s programs will demand slowly increasing support from the Trust Fund, to negate the impacts of inflation. To achieve this objective, while protecting principal, requires capital appreciation or additional contributions to the Trust Fund. This committee has been charged only with developing recommendations on investment management, and therefore makes no suggestions regarding fundraising solicitation to add to the principal in the Trust Fund. *

This is a critical statement because the Endowment Fund has received few new contributions — thus its real value or purchasing power has been eaten away due to inflation.

By early 1993, three years after this investment plan was embarked upon, the fund had a total value of $113,618 and had provided more than $44K in withdrawals for operating expenses, all on a total principal (at that time) of $93,605.62. Well done! This performance reflects returns on investment that were greater than the inflation rate for these years.

The what, why, and how of endowments for nonprofit organizations are reviewed next.

* Referenced from the following: “The Trust Fund,” dated September 1992; a committee memorandum to board titled “Proposed Investment Management Plan,” dated Feb. 12, 1990; and “Proposed Investment Management Plan,” dated Feb. 12, 1990.

LWVPDX Endowment Fund, Part 2: Endowments for Nonprofits

By Phil Thor, Endowment Chair, and the Endowment Committee

This is the second installment of a four-part series on the LWVPDX Endowment Fund. Part 1 reviewed the establishment and history of the endowment.

What is an Endowment?

According to the National Council on Nonprofits, an endowment is defined as “assets (usually cash accounts that are invested in equities or bonds or other investment vehicles) set aside so that these original assets (known as the corpus) grow over time as a result of income earned from interest on the underlying invested funds.”

Endowments are a key strategy for large institutions such as universities and hospitals. They regularly solicit future contributions, thereby adding to the corpus (or the sum of total contributions) over time. These contributions are generally larger than the budgetary needs of the organization when the funds were received. In addition, most endowments require that some or all of the contributed assets are restricted; the corpus must be kept intact so it can grow over time. The organization can only use investment income for operations or for what was specified by the donor.

Why Establish an Endowment

Nonprofit organizations establish an endowment primarily as a strategy for setting aside funds for future needs. An endowment also:

- Signals that an organization has long-term goals and wishes to persevere well into the future. And, endowment management provides assurances to donors that their contributions will support the organization long after the donors are gone.

- Provides a consistent annual stream of cash irrespective of fluctuations in donations, membership dues, and other income.

- Provides an account to receive large, one-time donations that cannot be expended during the organization’s fiscal year.

- Represents a secure fund that can attract future donations from patrons who also wish to support the operation of the nonprofit organization.

- Allows current, active members who donate to support the organization into the future.

- Restricts the fund so the endowment cannot be fully expended unless extraordinary or emergency conditions arise.

Disadvantages of an Endowment

Endowments, while advantageous, do have some drawbacks, and thus organizations that wish to create them should be aware of the administrative and fiduciary requirements to manage them properly.

- The annual distributions for supporting an organization’s current budget needs are usually much smaller than the corpus (principal), on the order of 3% to 6%, because the corpus must be retained.

- The value of the endowment over time is subject to the interest rate and financial market fluctuations in which investments are made, most notably the stock market.

- The corpus, while never being expended, will lose its purchasing power (i.e., “declining value of money”) due to consumer inflation. For example, a $1K donation made this year can be spent on a $1K of goods, products, or services this year. However, after three years have passed with, for example, 5% price inflation each year, that original $1K can only buy $857 worth of goods, products, or services. This occurs because the goods, products, or services have inflated and thereby cost more. And the purchasing power of the original $1K continues to decline at a compounding rate.

How Endowments Are Managed

To have an effective and — more importantly — growing endowment, an organization needs to have active, consistent oversight and management procedures governing the fund. This is usually accomplished through the adoption of an investment policy statement and a spending policy. The first statement documents the objectives, constraints, allocation among investment instruments, and acceptable risks for the fund and how the organization will manage that fund. The spending policy details how the earnings from the endowment investments are to be spent or used to support the organization’s needs.

In summary, when the current Endowment Fund was established (originally as a trust), LWVPDX considered the advantages, drawbacks, and the management procedures noted above — and the Endowment Committee continues to do so as it evolves. The provisions guiding the LWVPDX Endowment Fund were written into the Bylaws of the League of Women Voters of Portland, adopted by a vote of the LWVPDX membership in 1990, and subsequently amended several times through 2022. The basic tenets of this endowment remain unchanged since its inception.

Below are the members of the 2022-23 LWVPDX Endowment Fund Committee who manage the fund.

- Phil Thor, Chair

- Anne Davidson, Secretary

- Fran Dyke

- Susan Gilbert

- Elizabeth Joseph

Part 3 will continue this series by reviewing the current LWVPDX Endowment Fund Guidelines. It also responds to a concern expressed over changing the Endowment Fund’s investment objective.

|

|

|

LWVPDX Endowment Fund Part 4: Endowment Fund Recommendations

By Phil Thor, Endowment Chair, and the Endowment Committee

After a review of the Endowment Fund establishment and history (Part 1), endowments in general for nonprofit organizations (Part 2), and the current Endowment Guidelines (Part 3), the LWVPDX Endowment Committee has come to the following recommendations for modernizing those guidelines. The recommendations address several issues currently in the guidelines.

Recall, the current guidelines include the following provision:

The Endowment Committee’s recommendations are as follows.

1 — Clarify in the second sentence that the primary investment objective of the Endowment Fund is “to increase the value of the fund, so that a reasonable return for annual distribution can be accomplished.” This edit directly supports the next statement ,which reiterates the priorities of long-term growth and total return.

2 — Recognize that the investment objective is separate and distinct from the requirement to “maintain a fund value of at least the amount of principal that was originally donated.” Thus, we would:

- move the last sentence to a new paragraph

- accept additional wording that reflects the absolute need to retain the corpus (i.e., original donation amount) and acknowledges the continuing loss of the purchasing power to the fund

- tie the “distribution rate percentage,” set annually in January each year, to supporting the secondary objective to sustain and increase purchasing power of the fund.

3 — We recommend that development efforts, particularly regarding bequests, be vigorously pursued to grow the corpus of the Endowment Fund, which would in turn increase the value of the fund and thereby increase its annual contribution to the operating expenses. Additional contributions, while not improving the purchasing power of the original contributions, would increase the endowment value and allow for increasing budget draws, and would provide purchasing power more closely to that which was provided in the past.

4 — Finally, we note that the non-tax deductibility of contributions is a potential impediment for future contributions and suggest that the board explore possible solutions. This issue may be less of a concern if funds are from estates or bequests rather than from charitable contributions.

Amendments that reflect the above recommendation will be drafted and provided for voting this month. In the meantime, if anyone has comments on any part of this article, the Endowment Committee would be grateful to hear them. Please contact Phil Thor, committee chair, using the contact information listed in the membership directory.

This is the final installment of a four-part series on the League of Women Voters of Portland Endowment Fund. Part 1 reviewed the establishment and history of the endowment. Part 2 explored endowments for nonprofit organizations. Part 3 presented the current Endowment Guidelines and reviewed the questions that arose at the Annual Membership Meeting in May 2022.

NOTE: At the 2023 Annual Membership Meeting on May 24, the members voted to amend the Endowment Fund Guidelines as suggested in Part 4 above. You can read the amended Guidelines here.